iowa vehicle tax calculator

Type your numeric value in the appropriate boxes then click anywhere outside that box or press the tab key for the total amount Due. And serving as an agent of.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

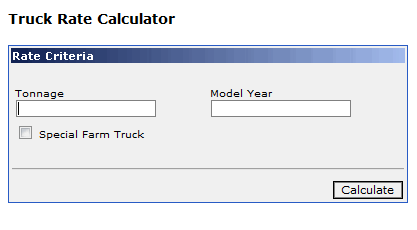

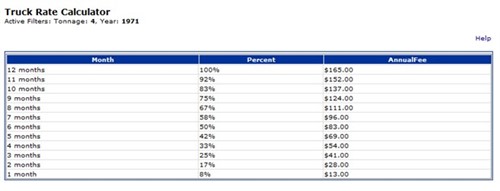

ZTruck rate calculator Enter truck tonnage information and calculate the cost of.

. Here is the example from the state website. 7 hours ago Click the following link to determine registration fees registration fees remaining on a vehicle that has been sold traded or junked estimate fees due on a newly acquired vehicle and calculate truck fees by tonnage. Uh oh please fix a few things before moving on.

Use the following worksheet to calculate the deductible amount of annual registration fees paid in 2019 for qualifying automobiles and multipurpose vehicles model year 2009 or newer. No permit other than an Iowa sales tax permit is required to collect and report these taxes. Vehicle Registration Fee Deduction and Worksheet.

How much will it cost to license my car in Iowa. To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Earlier this decade Iowa enacted one of.

See Iowa Vehicle Purchase and Lease Information and Forms. Sales of vehicles subject to registration are exempt from sales tax but are subject to a 5 fee for new registration. For example if you purchased a car with a sales price of 16000 the tax on the vehicle is 16000 multiplied by 625 percent or 1000.

Can you drive a car without plates if you just bought it in Iowa. The equivalent of sales tax in Iowa is called a One Time Registration Fee that is charged in addition to standard registration fees. For tax years 2008 and earlier pickup truck registration fees could not be taken as an itemized deduction because the fees were structured as a flat fee and.

The weight is found on your automobile registration certificate. Iowa Auto loan calculator is a car payment calculator with trade in taxes extra payment and down payment to calculate your monthly car payments. To calculate the sales tax on a vehicle purchased from a dealership multiply the vehicle purchase price by 625 percent 00625.

Notating and releasing security interests. 328 rows Taxes in Iowa. Take the weight of your automobile and divide it by 250.

Iowa has a 6 statewide sales tax rate but also has 609 local tax. Leased Vehicle Worksheet 35-050 Leased Vehicle Worksheet for Move-ins 35-051 Out-of-State Leased Vehicle Credit Worksheet 88-002 IA 843 Claim for Refund. Title Registration Plates.

Press tab for results. This is the computation borrowed from the states website. 305 cents per gallon of regular gasoline 325 cents per gallon of diesel.

In our calculation the taxable amount is 35250 which equals the sale price of 39750 minus the trade-in value of 2000 minus the rebate of 2500. Click on Tools Dealer inquiry Vehicle inquiry Search by VIN number title number or junking certificate. 153 average effective rates.

Get the actual annual registration fee paid. ZFee estimator Enter vehicle information and calculate the total f ees for a vehicle including the registration fee title fee plate fee use tax and recording fee. This is the deductible amount for line 37.

Processing credits and refunds on vehicle registration fees. INSTRUCTIONS FOR FEE CALCULATOR. How are Iowa vehicle registration fees calculated.

Iowa State Tax Quick Facts. For example if you purchased a car with a sales price of 16000 the tax on the vehicle is 16000 multiplied by 625 percent or 1000. Please select a county to continue.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Iowa local counties cities and special taxation districts. If you itemize deductions a portion of the automobile or multipurpose vehicle annual registration fee you paid in 2017 may be deducted as personal property tax on your Iowa Schedule A line 6 and federal Schedule A line 7. The annual registration fees are determined by Iowa Code sections 321109 and 321115 through 321124 and are to be paid to the county treasurers office in the county of residence.

Buying selling a vehicle. 040 per hundred pounds of vehicle weight plus a percentage of the vehicle list price reduced for older model years plus the supplemental registration fee based on vehicle type and phased in period. Calculate Your Transfer FeeCredit.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Remains on a current vehicle registration if the vehicle is sold traded or junked. Do not type commas or Dollar signs Into number fields.

A Brief Description of Motor Vehicle One-time Registration Fee. Iowa car payment calculator with amortization to give a monthly breakdown of the principal and interest that you will be. UT 510 Manual pdf Vehicle Rental Sales Use and Automobile Rental Tax.

You can use our Iowa Sales Tax Calculator to look up sales tax rates in Iowa by address zip code. Registration and document fees. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Iowa Sales Tax Calculator. The formula to calculate the registration fee for electric vehicles is as follows. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Subtract line 2 from line 1. Total Amount Paid Must be 99999999. Enter the amount paid in the top field the rest will auto-calculate.

Collecting one-time new registration fee aka. Calculate Your Transfer Fee Credit Iowa Tax And Tags. Motor Vehicle Fee for New Registration Purchases.

All vehicles must be registered to legally be driven in Iowa. To calculate the sales tax on a vehicle purchased from a dealership multiply the vehicle purchase price by 625 percent 00625. The County Treasurer is responsible for issuing vehicle titles registration renewals junking certificates personalized and other special emblem plates.

Income Tax Calculator 2021 2022 Estimate Return Refund

Tennessee Sales Tax Small Business Guide Truic

Car Tax By State Usa Manual Car Sales Tax Calculator

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Dmv Fees By State Usa Manual Car Registration Calculator

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Alaska Property Tax Calculator Smartasset

Quarterly Tax Calculator Calculate Estimated Taxes

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

The Average Percent Of Income Donated To Charity Can Improve

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Car Tax By State Usa Manual Car Sales Tax Calculator

California Vehicle Sales Tax Fees Calculator