florida estate tax exemption 2020

However if the current federal tax laws remain in place the exemption amount will be. 31 2022 to buy and move into your next Florida homestead.

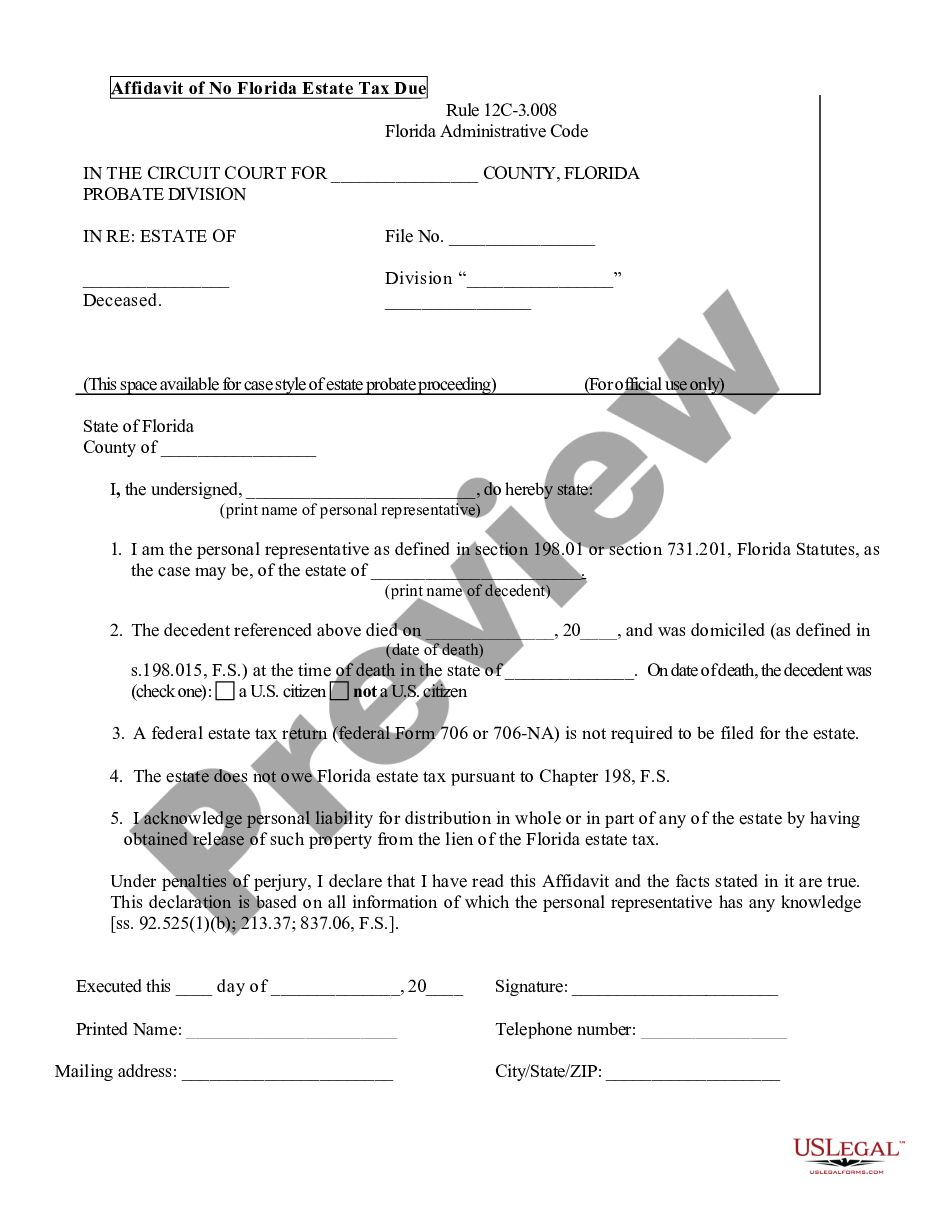

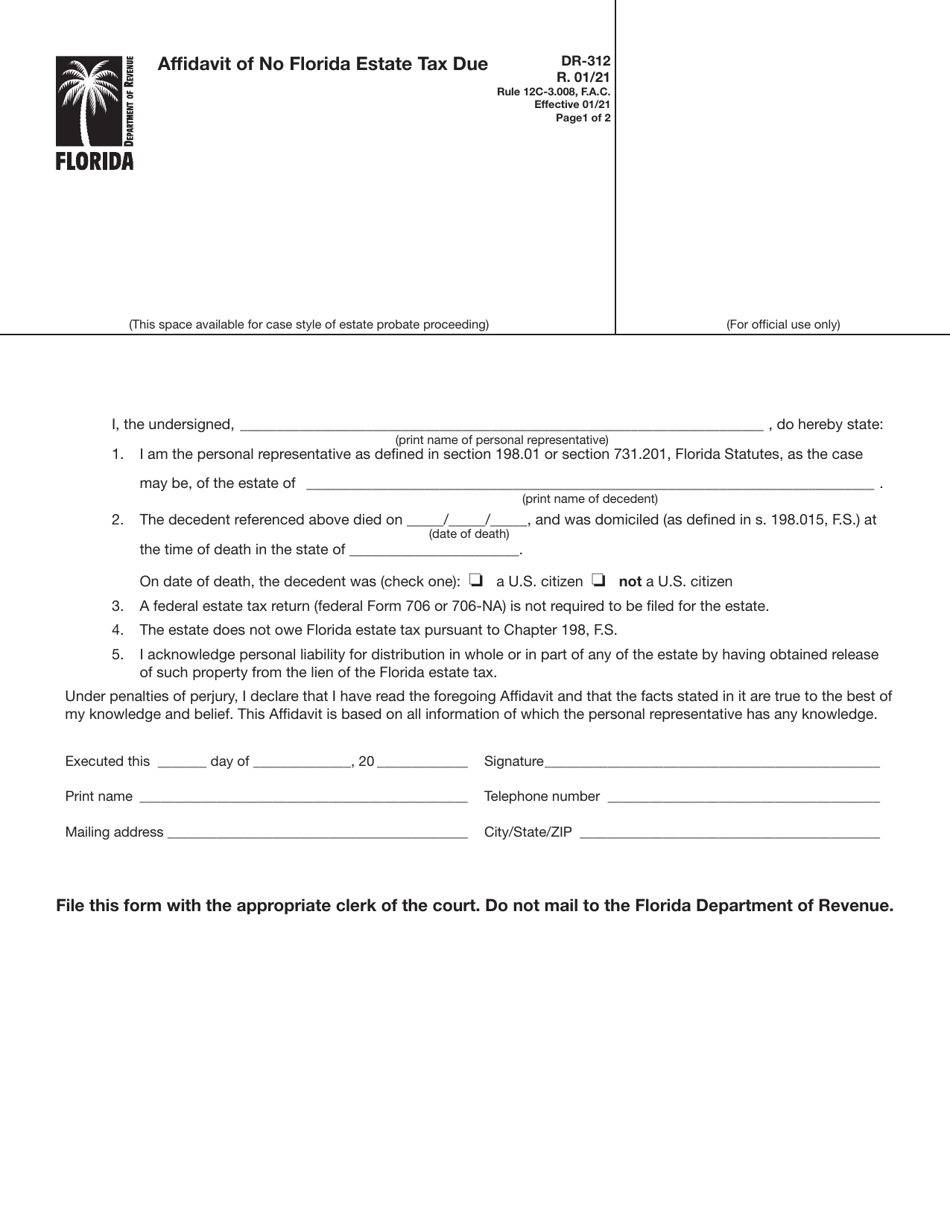

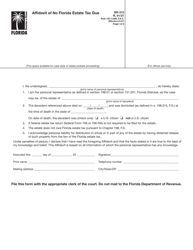

Affidavit Of No Florida Estate Tax Due Florida Estate Us Legal Forms

11292020 Federal Estate Gift and GST Tax.

. If you were divorced at the time of your ex. Generally a person dying between Jan. Citizen could die with an estate up to 11580000 and there would be no Federal estate tax due.

196173 Florida Statutes for the 2020 tax roll is. While Florida imposes neither an. If youre a Florida resident and the total value of your estate is less than 114 million you will pay neither state nor federal estate taxes.

The Florida Constitution prohibits income tax or inheritance tax. If an estate exceeds that amount the top tax rate is 40. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million.

As mentioned Florida does not have a separate inheritance death tax. Thanks to the passage of Amendment 5 on the November 2020 Florida ballot you now have until the end of the second year following the year in which you sell your homestead to establish your next Florida homestead. No estate tax or inheritance tax.

Because transfers to spouses are exempt married couples can effectively double the exemption to 2236 million through the use of estate-planning strategies like pass-through trusts for. Then you take the 1158 million number and figure out what the estate tax on that. The top marginal rate remains 40 percent.

As a result of recent tax law changes only those who die in 2019 with estates equal to or greater than 114 million must pay the federal estate tax. A person may be eligible for this exemption if he or she meets the following requirements. Florida Estate Tax Exemption 2020.

The estate and gift tax exemption is 1158 million per. Any assets left to your heirs will be taxed at a 0 rate up to 1158. Estate tax is calculated on all of your assets when you die and theres a nonrefundable credit equal to the tax that would be charged on the lifetime exemption 4577800 in 2020.

The Estate Tax is a tax on your right to transfer property at your. 2020 Estate Gift GST and Trusts Estates Income Tax Rates. Technically this is structured as a tax credit.

You also pay 34 on the remaining 70000 which comes to 23800. Federal Estate Tax Explained. View Federal Estate Gift and GST Tax Exemptions Update 2020pdf from TAX 6726 at University of Florida.

2020 Homestead Exemption All qualified Florida residents are eligible to receive a Homestead Exemption on their homes condominiums co-op apartments and certain mobile home lots. Federal Estate Taxes. Sticky Post By On 24.

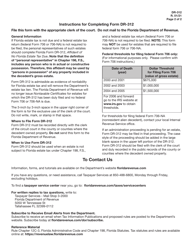

Owns real estate and makes it his or her permanent residence Is age 65 or older Household income does not exceed the income limitation see Form DR-501 and Form DR-501SC see section 1960752 Florida Statutes. At the time of this writing in 2020 based on the Unified Credit each US. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due Florida Form DR-312 to release the Florida estate tax lien.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023 Delaware. No Florida estate tax is due for decedents who died on or after January 1 2005.

For 2020 estate tax rates start at 18 and reach 40 for assets worth more than 1 million. No estate tax or inheritance tax. Form 4768 Application for Extension of Time to File a Return andor Pay US.

For married couples that amount is doubled since each spouse is entitled to the exemption and each spouses exemption is portable to the last spouse to die. 2 enforce child support law on behalf of about 1025000 children with 126 billion collected in fy 0607. Any assets left to your heirs will be taxed at a 0 rate up to 1158 million and at a 40 rate beyond that amount.

31 2020 may be subject to an estate tax with an applicable exclusion amount of 11580000 increased from 114 million in 2019. The estate and gift tax exemption is 1158 million per. To qualify for Homestead Exemption you must own and make the property your permanent residence on January 1 of the year for which you are applying for this valuable.

Property taxes in Florida are right in the middle of the pack nationwide with an average effective rate of 102. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax. The federal estate tax only applies if the value of the entire estate exceeds 12060000 million 2022 and the tax thats incurred is paid out of.

This may sound complicated but the end result is actually quite simple. State law specifically mentions blindness use of a wheelchair for mobility and other partial and total disabilities as qualifying conditions for this exemption. If you have disabilities you may qualify for a 500 property tax deduction.

This may sound complicated but the end result is actually quite simple. If you sold in December 2020 you have until Dec. The Form 706-NA United States Estate and Generation-Skipping Transfer Tax Return Estate of nonresident not a citizen of the United States if required must be filed within 9 months after the date of death unless an extension of time to file was granted.

Florida estate tax exemption 2020. The federal government however imposes an estate tax that applies to all United States Citizens. The Internal Revenue Service announced today the official estate and gift tax limits for 2020.

Property Tax Exemptions Available in Florida for People with Disabilities.

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

The Scope Of The Rules Tax Adviser

Florida Inheritance Tax Beginner S Guide Alper Law

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Attorney For Federal Estate Taxes Karp Law Firm

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Will My Florida Estate Be Taxed Nici Law Firm P L Naples Fl

Florida Inheritance Tax Beginner S Guide Alper Law

![]()

Florida Inheritance Tax Beginner S Guide Alper Law

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

3 Transfer Taxes To Minimize Or Avoid In Your Estate Plan

Florida Estate Tax Rules On Estate Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Estate Planning Guide Everything You Need To Know

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Restoring The Federal Estate Tax Is A Proven Way To Raise Revenue And Address Wealth Inequality Equitable Growth